E-İHRACAT ÇÖZÜMLERİ

Avrupa pazarına açılmak mı istiyorsunuz? E-ticaret potansiyelinizi sınırların ötesine taşıyın. Hollanda merkezli deneyimli ekibimizle, Türkiye'den Avrupa'ya sorunsuz ve başarılı bir e-ihracat yolculuğu için size rehberlik ediyoruz.

- Avrupa ve Türkiye Piyasasına Hakimiyet: Hollanda'daki konumumuz ve Türkiye'deki güçlü bağlarımız sayesinde, her iki pazarın dinamiklerini de yakından biliyoruz.

- E-İhracat Danışmanlığı:: Avrupa e-ticaret pazarına giriş stratejileri, hedef pazar analizi, ürün uygunluğu değerlendirmesi ve ihracat süreçleri hakkında kapsamlı danışmanlık hizmetleri sunuyoruz. Size özel yol haritaları çizerek, riskleri minimize ediyor ve başarıya ulaşmanızı sağlıyoruz.

- E-Ticaret Pazar Yerleri: Avrupa'daki önde gelen e-ticaret platformları hakkında derinlemesine bilgi ve uzmanlık sunuyoruz. Ürünlerinizin doğru pazar yerlerinde listelenmesi, mağaza kurulumu ve optimizasyonu konularında size destek oluyoruz. Avrupa'nın dinamik e-ticaret ekosisteminde yerinizi almanıza yardımcı oluyoruz.

- Konsinye Stok: Digizoom olarak Türkiye'den Avrupa'ya web siteniz be pazaryerlerinde satılacak ürünleriniz için konsinye stok tutulması için proxy hizmetleri sağlıyoruz. Bu şekilde Avrupa'da stok tutabilmenizi sağlıyoruz.

- Avrupa'da Şirket Kurulumu: Avrupa pazarında kalıcı bir varlık oluşturmak isteyen işletmeler için Hollanda ve diğer Avrupa ülkelerinde şirket kurulum süreçlerinde danışmanlık sağlıyoruz. Yasal gereklilikler, vergi düzenlemeleri ve bürokratik işlemler konusunda size yol göstererek, işinizi Avrupa'da sağlam temeller üzerine inşa etmenize yardımcı oluyoruz.

- Deneyimli ve Uzman Kadro: E-ticaret ve e-ihracat alanında yılların deneyimine sahip uzman bir ekibiz.

- Türkiye'den Avrupa'ya: Türkiye'den Avrupa'ya e-ihracat yolculuğunuzda size sadece danışmanlık yapmakla kalmıyor, aynı zamanda uzun vadeli bir iş ortağı olarak destek oluyoruz.

Avrupa'ya Açılan Kapınız

Digizoom İle Çalışın.

AVRUPA PAZARYERLERİ VE LOJİSTİK

Avrupa'da e-ticaretin kalbinde yer almak mı istiyorsunuz? Eihracat olarak, Amazon, Bol.com ve diğer yerel pazar yerlerinde güçlü bir varlık kurmanız için uçtan uca destek sağlıyoruz. Ürün yüklemeden depolamaya, satış yönetiminden iade süreçlerine kadar her adımda yanınızdayız.

Amazon Avrupa, Bol.com ve Yerel Pazar Yerlerinde Destek

- Avrupa'nın en büyük ve en prestijli pazar yerlerinde markanızı büyütün!

- Amazon (US, MX, CA, DE, FR, NL, IT, ES, PL, SE, BE) ve Bol.com’da hesap açılışı

- Ürün listeleme ve kategori optimizasyonu

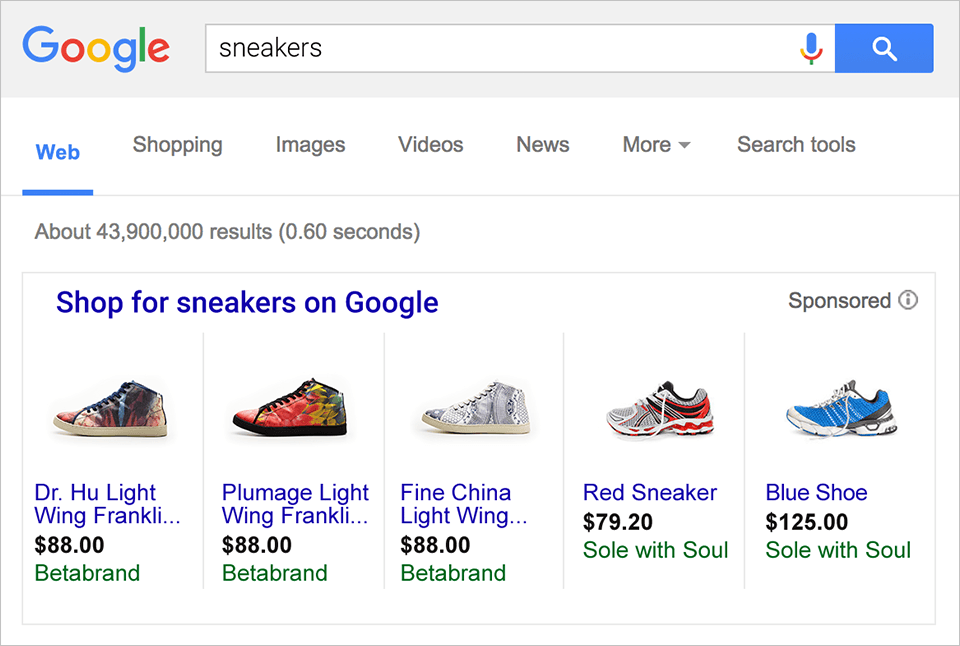

- Anahtar kelime (SEO) çalışmaları ile görünürlük artırımı

- Pazar yeri içi reklam (sponsored ads) ve promosyon yönetimi

- Satış performansı takibi ve raporlama

Ürün Yükleme ve Katalog Yönetim

- Ürünlerinizin doğru ve etkili bir şekilde listelenmesini sağlıyoruz.

- Ürün bilgisi ve açıklama yazımı (çok dilli destek)

- Görsel optimizasyon ve varyant yönetimi

- Fiyatlandırma ve stok yönetimi stratejileri

- Ürün onay ve yayına alma süreçleri takibi

Depolama ve Sevkiyat Hizmetleri

- Ürünleriniz Avrupa içinde hızlı ve ekonomik şekilde müşterilere ulaşsın. Digizoom, sizin ürünlerinizi Avrupa'da proxy olarak konsinye stoklama yapar ve satıldıkça size raporlama ve ödeme yapar.

- Avrupa merkezli depo ağı kullanımı.

- Siparişlerin toplanması, paketlenmesi ve gönderimi

- Amazon FBA ve Bol.com fulfillment süreçleri desteği

- Pazar yeri içi reklam (sponsored ads) ve promosyon yönetimi

- İade lojistiği ve ürün kabul hizmeti

- İade oranlarını azaltmaya yönelik stratejik danışmanlık

SHOPIFY E-TİCARET SİTESİ

Digizoom, resmi Shopify Partner olarak markanızın dijital dünyada güçlü ve sürdürülebilir bir varlık oluşturmasını sağlar. İster sıfırdan bir mağaza kurmak isteyin, ister mevcut mağazanızı büyütmek, Shopify uzman ekibimizle her adımda yanınızdayız.

Shopify ile Başarınıza Yön Veriyoruz

Shopify Mağaza Kurulumu

- İlk adımda güçlü bir temel oluşturun!

- Size özel tasarlanmış Shopify mağaza kurulumu

- Mobil uyumlu ve hızlı yüklenen temalar seçimi

- Ürün kategorileri, koleksiyonlar ve filtreleme ayarları

- Ödeme, kargo ve vergi ayarlarının yapılandırılması

Shopify Uygulama Entegrasyonları

- İşinizi kolaylaştıracak güçlü araçlar sunuyoruz.

- Stok yönetimi, lojistik ve CRM entegrasyonları

- Pazarlama otomasyonları ve e-mail sistemleri kurulumu

- Analitik ve raporlama araçlarının entegrasyonu

- Satış artırıcı uygulamalar (upsell, cross-sell, review apps)

Shopify'da Avrupa Pazarı için Özel Çözümler

- Avrupa'ya satış yapmak için Shopify'ı tam verimle kullanın.

- Çok bölgeli fiyatlandırma ve kargo ayarları

- Avrupa vergi sistemlerine (KDV/BTW) uygunluk

- Yerel ödeme yöntemleri entegrasyonu (iDEAL, Bancontact vb.)

- Avrupa lojistik ve fulfillment entegrasyonları 👉 "Markanız için Shopify'da güçlü bir başlangıç yapın. Shopify danışmanlık için hemen bizimle iletişime geçin!"

E-TİCARET ÇÖZÜMLERİ

Küreselleşen dünyada e-ticaret, işletmeler için büyüme ve yeni pazarlara ulaşma konusunda eşsiz fırsatlar sunuyor. Özellikle Avrupa pazarı, Türk ürünleri için büyük bir potansiyel barındırıyor. Ancak bu pazara giriş yapmak, doğru stratejileri, yasal düzenlemeleri ve kültürel farklılıkları anlamayı gerektirir. İşte tam bu noktada devreye giriyoruz. E-ticaret dünyasında başarı, sadece ürün satmakla değil, doğru stratejilerle büyümekle mümkündür. Eihracat olarak, markanızın dijitalde güçlenmesi için uçtan uca e-ticaret desteği sunuyoruz.

- Dijital Pazarlama (Digital Marketing):: Markanızın doğru kitlelere ulaşmasını sağlıyoruz ve bunu performans odaklı reklam kampanyaları (Meta, Google Ads, TikTok Ads), gelişmiş ve odaklı E-mail pazarlama stratejileri, içerik pazarlaması ve SEO çalışmaları, sosyal medya yönetimi ve marka bilinirliği artırımına yönelik çalışmalarla yapıyoruz.

- Ölçümleme ve Analiz (Measurement): Veri olmadan gelişim olmaz! Tüm çalışmalarımızı doğru veriyle destekliyoruz. Bunun için Google Analytics ve e-ticaret izleme kurulumu, dönüşüm oranı optimizasyonu (CRO) takibi, trafik kaynaklarının ve kullanıcı davranışlarının analizi, A/B testleri ve sonuç analizi yapıyoruz ve ölçümleme stratejileri geliştiriyoruz.

- Hedefleme (Targeting): Ürünlerinizi en doğru müşterilere ulaştırıyoruz. Bunun için yeniden hedefleme (retargeting) kampanyaları, segment bazlı kullanıcı yönetimi, bölgesel ve demografik odaklı kampanyalar ve stratejiler geliştiriyoruz.

- E-Ticaret Reklamları (Danışmanlık): Avrupa'daki dijital reklamcılık trendleri ve etkili pazarlama stratejileri konusunda size danışmanlık yapıyoruz. Hedef kitlenize ulaşacak, marka bilinirliğinizi artıracak ve satışlarınızı yükseltecek reklam kampanyaları oluşturmanız için size rehberlik ediyoruz. Doğrudan reklam yönetimi yapmamakla birlikte, doğru ajans seçimi ve strateji geliştirme konularında yanınızdayız.

E-İHRACAT YOL ARKADAŞINIZ

Digizoom hızla büyüyen küresel bir e-ihracat danışmanlık firmasıdır. Amacımız, müşterilerimize güçlü teknik uzmanlığa ve üstün iletişim becerilerine sahip danışmanlar sunarak, uluslararası pazarlarda sürdürülebilir başarı sağlamaktır. Eihracat olarak, teknolojinin dünyada pozitif bir değişim yaratma potansiyeline yürekten inanıyoruz. Bu hedef doğrultusunda, kişisel gelişimi teşvik eden ve yaratıcı düşünceyi destekleyen bir çalışma ortamı oluşturuyoruz. Danışmanlarımıza ve müşterilerimize, en karmaşık ticari zorlukları aşmaları için yenilikçi çözümler sunuyoruz. Yeniden kullanılabilir iş modelleri geliştirerek, öncü strateji şablonları oluşturarak ve teknoloji destekli ihracat çözümleri sunarak müşterilerimizin işlerine sürekli değer katıyoruz.

Digizoom Partners Çözümleri

Digizoom danışmanlığı ve kontrolü altında partner çözümlerimiz

Depolama, Sevkiyat ve İade Yönetimi

Siparişlerinizi Avrupa içinden hızlı, güvenli ve uygun maliyetli şekilde yönetiyoruz.

Avrupa'da ve Hollanda'da Şirket Kurulumu

Avrupa pazarına doğrudan giriş için şirket kuruluş süreçlerinde yanınızdayız.